- 국내ㆍ외 관련 뉴스

국내ㆍ외 관련 뉴스

C1 가스 리파이너리 사업단

Market

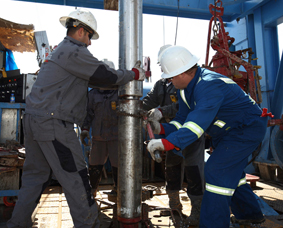

U.S. shale’s quick response to falling oil prices is paying off

CALGARY (Bloomberg) --In brokering the end to the global oil-price war last month, the Trump administration assured leaders that America’s shale patch would throttle back production. But few expected that the cuts would run this deep -- and happen so quickly. Drillers are laying down rigs and shutting in wells at a frantic pace in response to the plunge in oil prices caused by the coronavirus pandemic.

Business

How U.S. Shale Can Survive The Oil Crash

The question regarding whether we have reached peak oil demand is a pressing concern for U.S. upstream activity. U.S. tight oil’s current cost structure, which generally requires ~$50/barrel WTI to make it economically viable, suggests that oil demand needs to return to pre-COVID levels for U.S. shale to recover (Fig. 1). This article considers the industry’s ability to lower its cost structure further in order for it to maintain competitiveness.

America’s Oil And Gas Jobs Could Soon Come Roaring Back

Bill Gilmer knows an economic bust when he sees one. In the 1980s, when oil prices tumbled amid a supply glut, Gilmer watched as Houston’s office space cleared out and stayed out. “If you live in Houston, you know a speculative bust when you see one,” said Gilmer, the director of the Institute for Regional Forecasting at the University of Houston's Bauer College of Business. “Those jobs never came back.”

Technology

Policy

Why U.S. Shale Is Too Important To Fail

It may well be the case that the U.S. shale sector has cut over US$50 billion from its planned spending this year, the number of operating rigs has fallen by 40 per cent in the past four weeks, and output has fallen by nearly one million barrels per day (bpd) over the same period.