- 국내ㆍ외 관련 뉴스

국내ㆍ외 관련 뉴스

C1 가스 리파이너리 사업단

Market

Shale CEO: U.S. Has Passed Peak Oil

Crude oil production has already peaked in the United States, according to a leading independent oil producer in the U.S. shale patch. Chief executive of Parsley Energy Matt Gallagher said that the peak production that the United States hit back in March—13.1 million bpd on average—represented shale’s glory days, ne’er to be repeated, according to the Financial Times.

Shale drillers plan for maintenance, not growth, as oil prices stall

HOUSTON (Bloomberg) --America’s most prolific shale drillers are accepting a fate once anathema to an industry obsessed with growth: Drilling just to ward off production drops. The pandemic and subsequent plunge in crude prices has forced U.S. crude explorers to scrap plans to expand supplies amid investor skepticism toward the shale business model.

U.S. Shale Remains In Survival Mode For Another Year

After slashing capex plans for 2020 and idling rigs by the dozen, U.S. shale drillers are still not ready to return to their default state of perpetual growth. Oil is simply too cheap for that, so they are staying in survival mode, maintaining production with no plans to start boosting it anytime soon.

Oil Prices Will Spike Because Linear Extrapolations Have Never Worked For Oil Markets

Back in March/April when the Saudis declared an oil price war on the world, analysts and pundits started predicting how global oil inventories will reach tank top. The rationale was that, if demand fell by ~30 mb/d and Saudi was not cutting production, storage would be full by May, and as a result, global oil prices will go to negative.

Business

Chevron to Build 500MW of Renewables to Power Oil and Gas Facilities — and It’s Considering More

Chevron announced it will build 500 megawatts of renewable energy plants to power some of its global facilities, in what amounts to a sizable clean energy expansion for an oil giant with comparatively few big investments in renewables to date.

한화 '참여' 4兆 美 ECC 인수戰...국내 IB 명함도 못내밀어

몸값만 4조원. 한화(000880)가 글로벌 화학기업인 사솔의 미국 내 에탄크래커(ECC) 화학단지 인수전에 참여한다는 소식에 국내 투자은행(IB) 업계가 술렁였다. 신종 코로나바이러스 감염증(코로나19) 확산 후 인수합병(M&A) 시장이 급랭하면서 증권사 등은 그동안 이렇다 할 투자실적을 거두지 못했다. 간만에 등장한 2조원 안팎의 인수금융 ‘대어(大魚)’를 따내면 부진했던 실적도 만회할 수 있었다. 하지만 결국 이번 인수전의 자금조달은 시중은행의 ‘돈잔치’로 막을 내렸다.

Technology

A Double Vision: Service Companies Aim To Save Shale Dollars With Simultaneous Completions

Two wells with one spread. This drone photo from April shows the well pad in south Texas where Schlumberger and Sundance Energy stimulated two wells simultaneously. The approach is being touted by several pressure pumping companies as a way for shale producers to save on completions which consume 60 to 70% of the total cost to bring in a new well. Source: Schlumberger

Policy

Deutsche Banks won’t finance any new Arctic oil and gas projects

The Frankfurt-based bank adopted its new Fossil Fuels Policy on Monday with strict limitations on future involvement in coal, oil and gas. With immediate effect, the bank, which is the world’s 17th largest, says it «will no longer finance any new projects in the Arctic region.

정병선 과기부 차관 “기후변화 위기 속에서 화학산업의 R&D 중요”

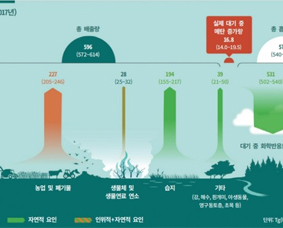

과기정통부 정병선 제1차관은 13일 차세대 화학산업 패러다임 대응 전문가 간담회를 개최하고, 기술개발 추진 방향을 논의했다. 석유 등 화석연료에 의존해온 기존의 화학산업은 지구온난화, 환경오염 등 기후변화 위기에 직면해 왔으며, 그간 정부는 미활용·신규 바이오매스 확보 및 바이오매스 연료화를 위한 원천기술개발, 이산화탄소 포집·저장·활용 기술개발(CCUS, Carbon Capture, Utilization and Storage) 및 실증 모델 확보 등 기후변화 대응 기술개발사업을 지원해왔다.

Saudi Arabia Refuses To Learn From Its Two Failed Oil Price Wars

Having failed to achieve the slightest semblance of success in the two oil price wars that it started – the first running from 2014 to 2016, and the second running from the beginning of March to effectively the end of April this year – it might be assumed that key lessons might have been learned by the Saudis on the perils of engaging in such wars again.