- 국내ㆍ외 관련 뉴스

국내ㆍ외 관련 뉴스

C1 가스 리파이너리 사업단

Market

U.S. Shale Has Lost $300 Billion In 15 Years

The U.S. shale industry peaked without ever making money. Over the past decade and a half, the shale industry totaled $300 billion in net negative cash flow, wrote down another $450 billion in invested capital, and saw more than 190 bankruptcies since 2010, according to a new report from Deloitte.

After decade of excess, US shale industry will take years to recover

As oil prices tick up to $40 a barrel following a pandemic-induced plunge, there’s a sense the shale industry is snapping back to life with Continental Resources Inc., EOG Resources Inc. and Parsley Energy Inc. all saying they’re restarting closed wells.

$40 Oil Isn’t Enough To Prevent A Wave Of Shale Bankruptcies

The coronavirus pandemic and the oil price collapse are accelerating the pace of bankruptcy filings in the U.S. shale patch this year. The number of filings had already started to trend up in 2019 after a drop in prices in Q4 2018, but this year, the U.S. energy industry is setting some grim records as indebted cash-strapped producers face a day of reckoning from the borrowing exuberance of the past years.

Shale May Not Recover From Pandemic

The U.S. oil industry may have already peaked, with an all-time high in production reached just a few months ago. The U.S. shale boom was already slowing down heading into 2020. The global pandemic and macroeconomic hit will leave permanent scars, from which shale drilling will be unlikely to recover.

Business

Technology

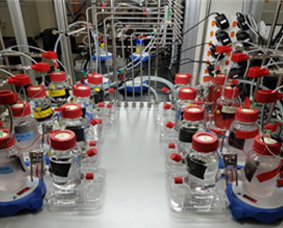

There's a Sustainable New Way to Convert CO2 Waste Into Building Blocks For Fuel

Synthetic gas, or syngas for short, is a crucial building block in the chemical manufacturing industry. Most people may never have heard of syngas, but every day it is used in the production of drugs, fertiliser, plastic, and biofuels.

Crude Oil Shortages Beginning To Bite In Key Markets

Last month, OPEC and its non-OPEC allies, known as OPEC+, agreed to extend their deep production cuts through July in an effort to rebalance oversupplied markets in the face of pandemic-hit demand. The cuts were supposed to take ~10% off the markets with July's cut clocking in at 9.6 million bpd.

A Double Vision: Service Companies Aim To Save Shale Dollars With Simultaneous Completions

Two wells with one spread. This drone photo from April shows the well pad in south Texas where Schlumberger and Sundance Energy stimulated two wells simultaneously. The approach is being touted by serveral pressure pumping companies as a way for shale producers to save on completions which consume 60 to 70% of the total cost to bring in a new well. Source: Schlumberger

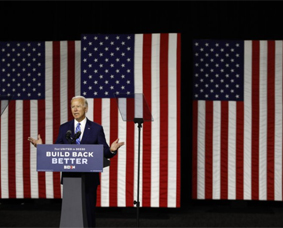

Policy